BASQUE COUNTRY (SPAIN) FRANCE PORTUGAL LUXEMBURG GERMANY

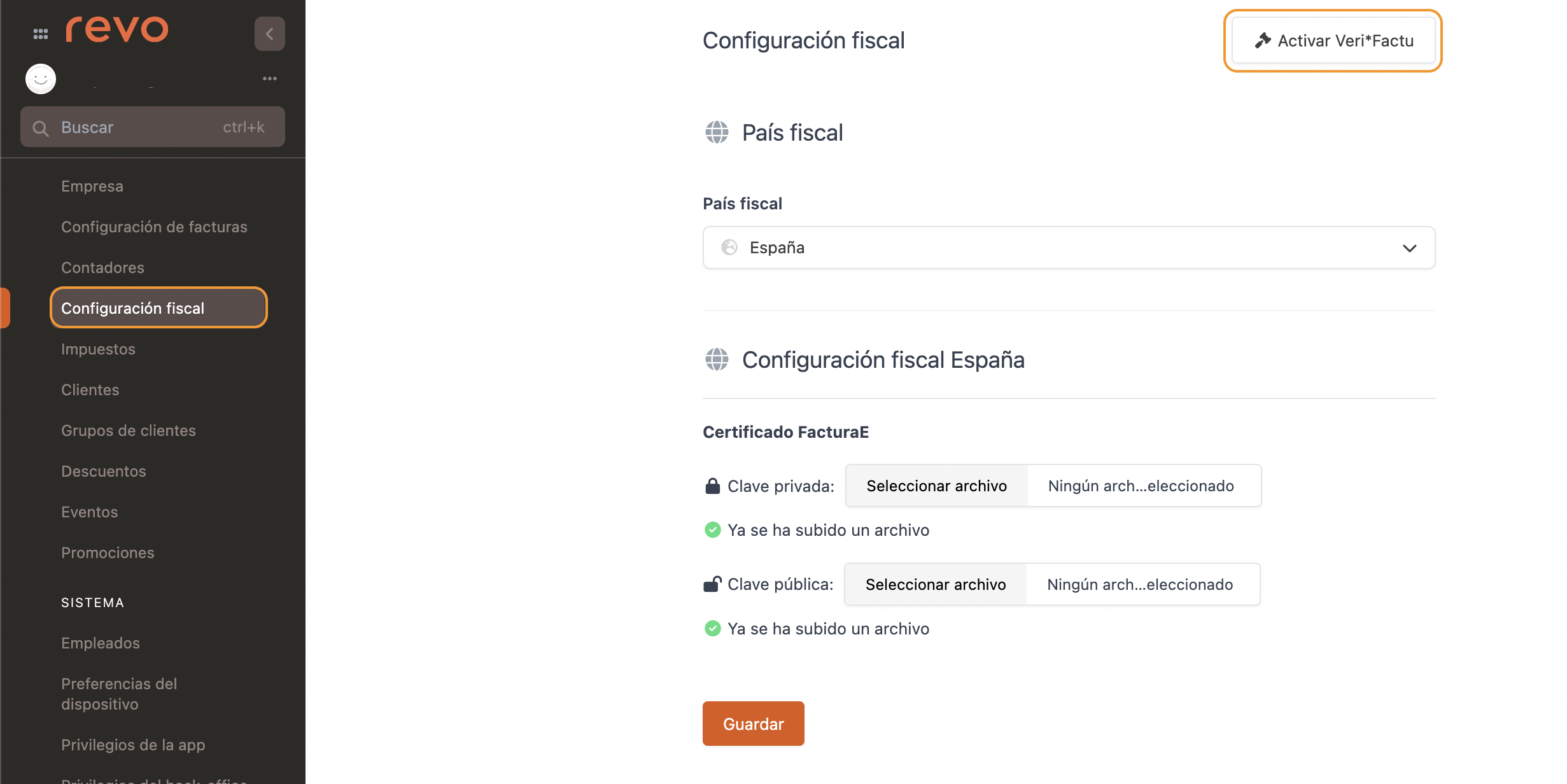

Once the account is created, ensure that the tax configuration is correct. To do this:

1. Go to the back-office of Revo XEF.

2. Go to Configuration / TAX CONFIGURATION.

-

Tax country: Select the country.

-

Test: Deactivate when you stop testing.

IMPORTANT: This action is irreversible. Once deactivated, the data will be sent to production.

These keys must be provided by the customer.

-

Private key: Add the private key. A will appear.

-

Public key: Add the public key. A will appear.

Once the test is deactivated, you will not be able to modify the keys.

3. Click Save to confirm.

COMING SOON

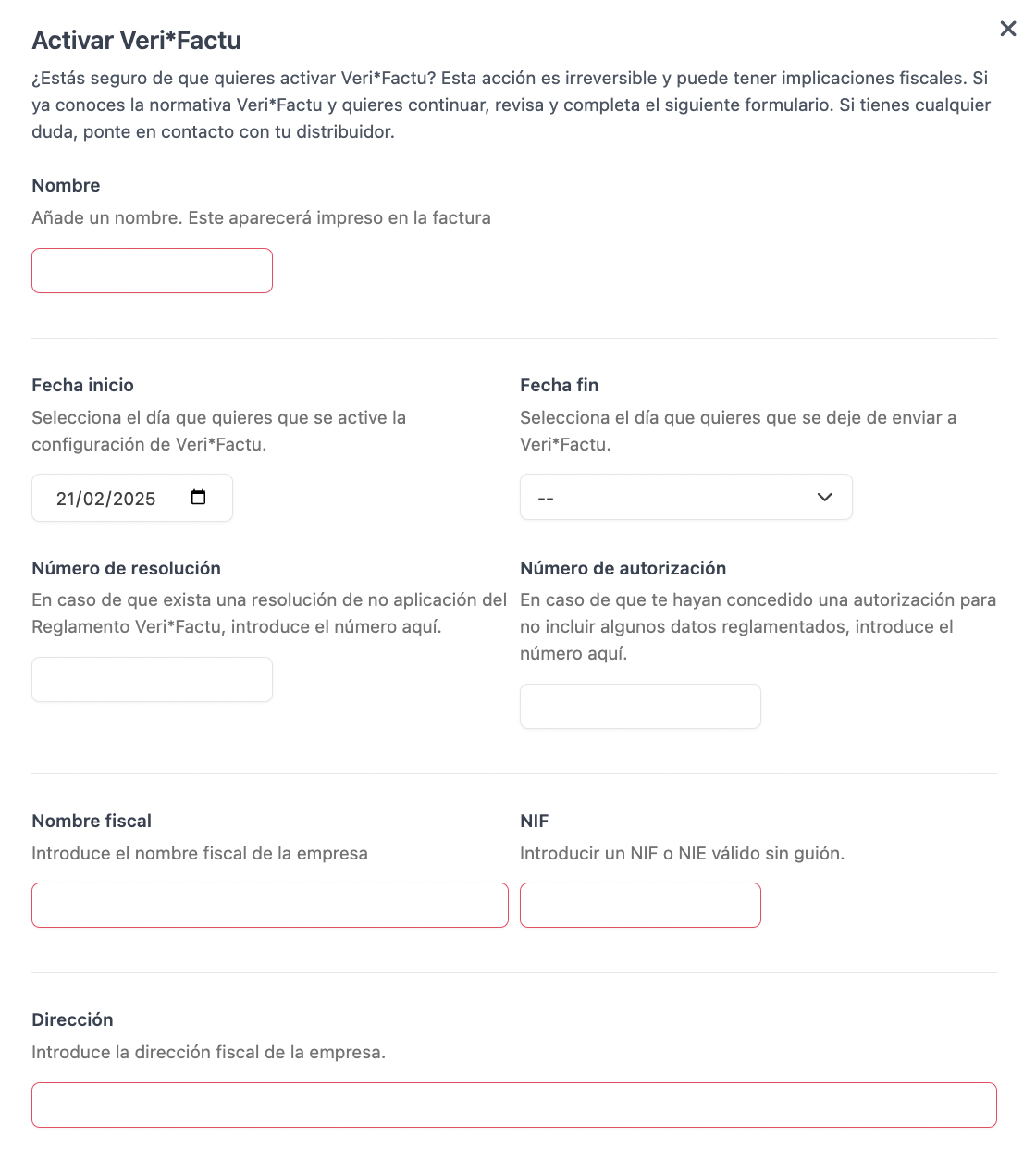

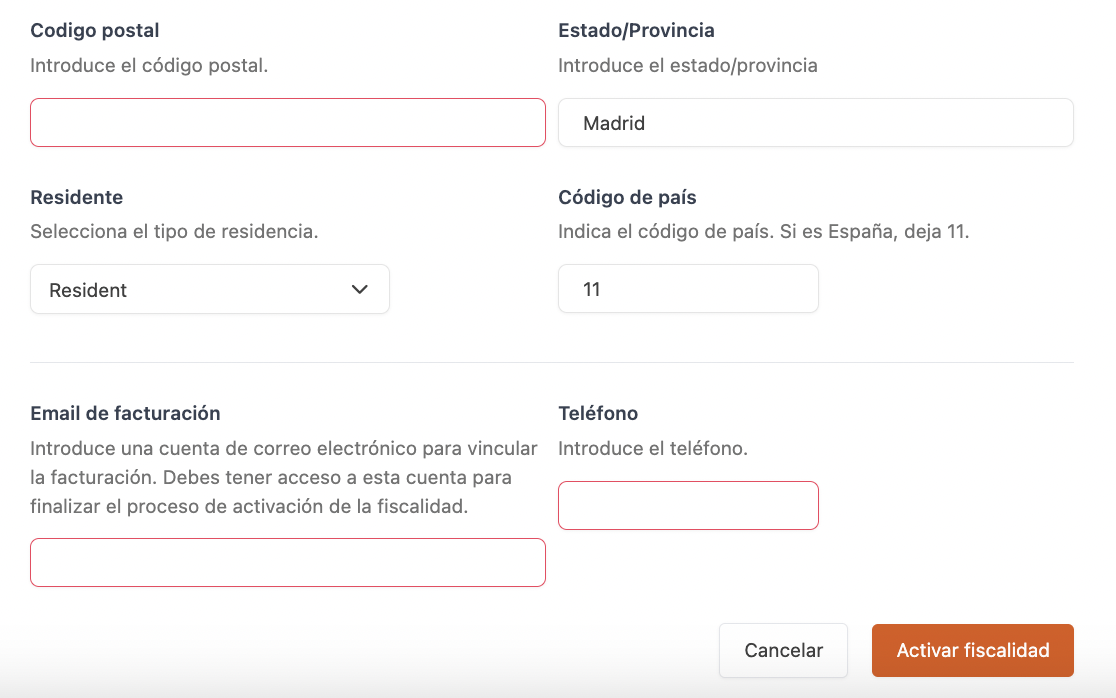

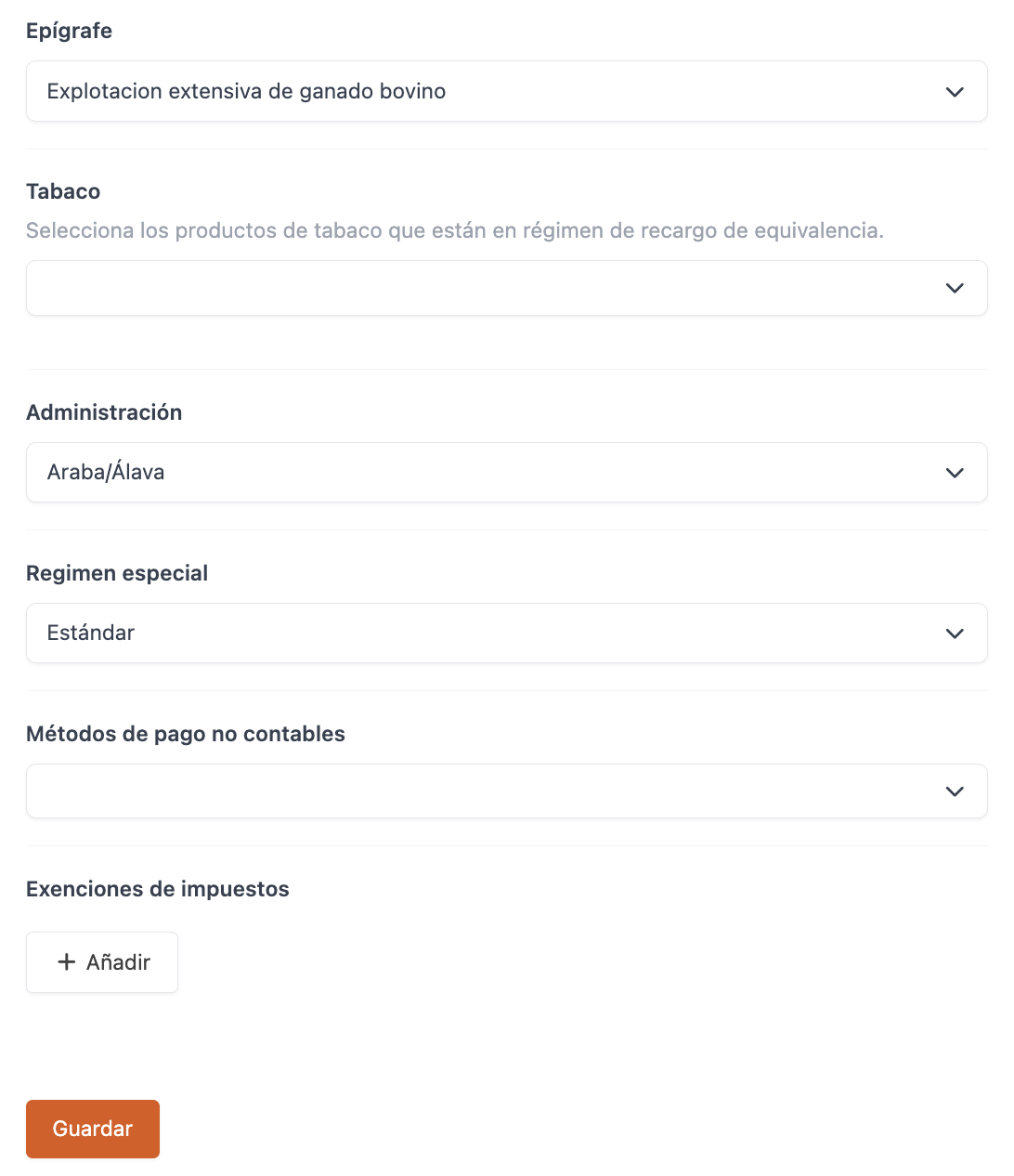

Tax compliance will be in test mode by default. When you want to switch to production, you will need to press Activate Veri*Factu, complete the following details, and press Activate tax.

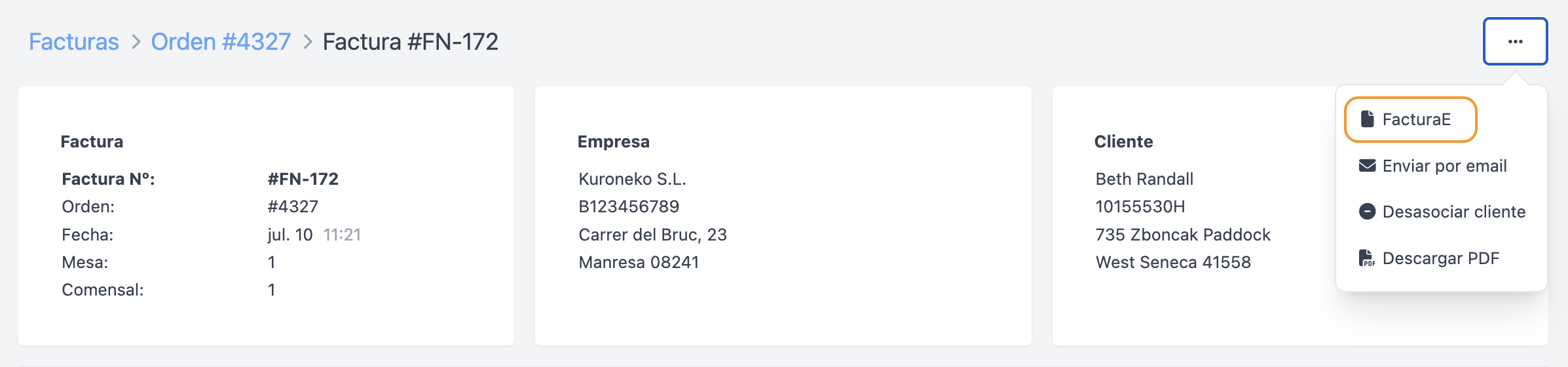

HOW THE E-INVOICE WORKS

Once the keys are added, you can download the e-Invoice for individual and grouped invoices. The XML can be uploaded to the electronic site.

COMING SOON

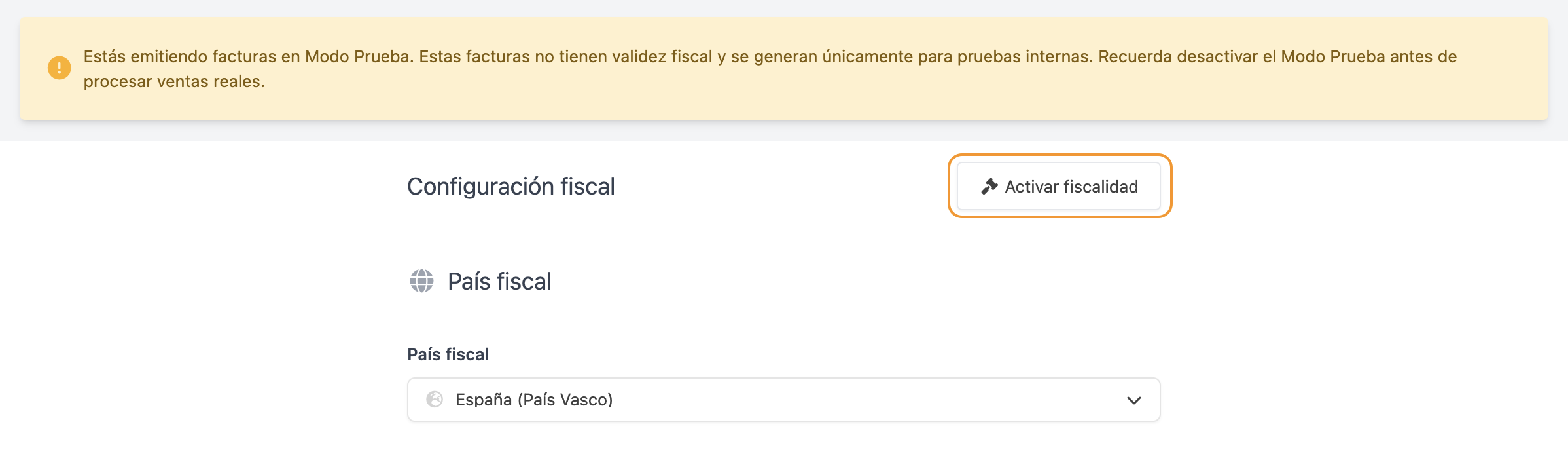

Until tax is activated, a message will appear indicating this:

Once you have completed the information and want to send the billing to production, you will need to press Activate tax.

A confirmation message will appear. If you are sure, press Activate tax.

COUNTRIES WITH EXTRA TAX CONFIGURATION

For the Basque Country (Spain), France, Portugal, Luxembourg, and Germany, you will need to add more information when configuring taxes.

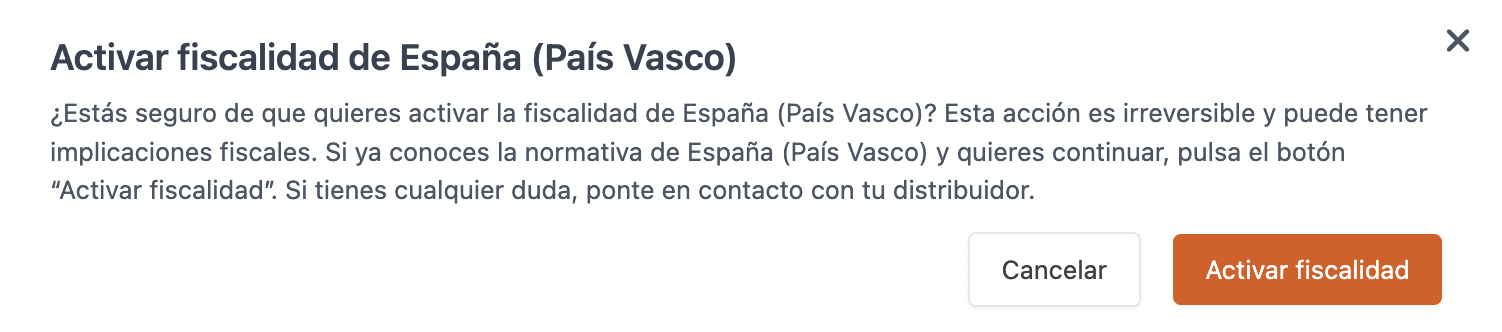

BASQUE COUNTRY (Spain)

-

Fiscal Country: Select Spain (Basque Country).

-

Taxpayer: Choose Individual or Legal Entity.

If you select Legal Entity, not all the mentioned options will appear.

-

First Name: Owner's first name.

-

Last Name: Owner's last name.

-

Category: Select the appropriate category for your services.

-

Tobacco: Specify if it falls under the equivalence regime.

-

Administration: Select your province (Gipuzkoa, Bizkaia, or Araba).

IMPORTANT: Once the test mode is deactivated, administration cannot be changed. Invoices sent to the wrong administration cannot be transferred and must be sent manually.

-

Special Regime: Select the applicable regime.

-

Non-accountable Payment Methods: Choose your non-accountable payment methods.

-

Files: Review the XML files sent to TicketBAI and their status.

Here you will find more information about Basque taxation.

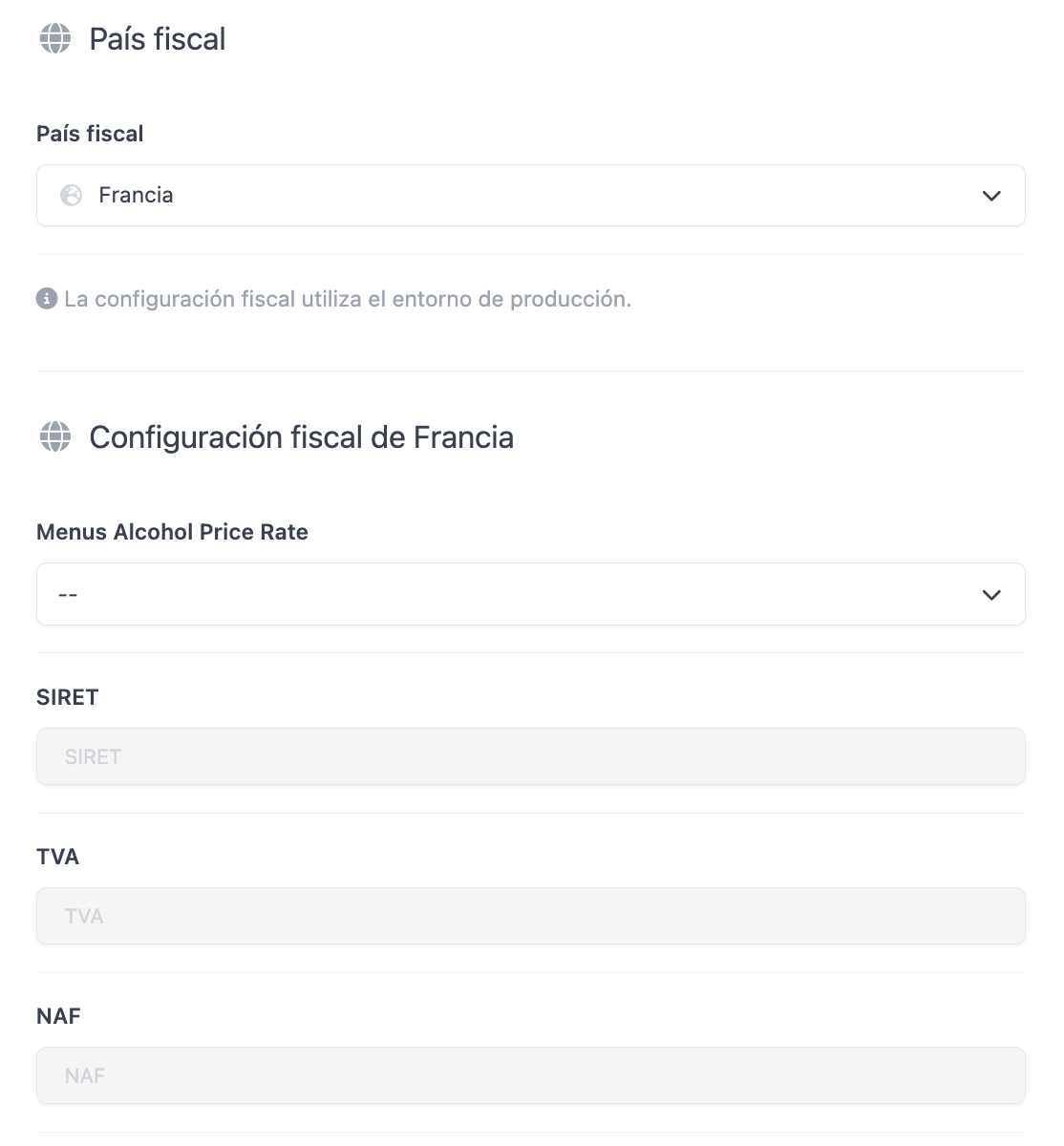

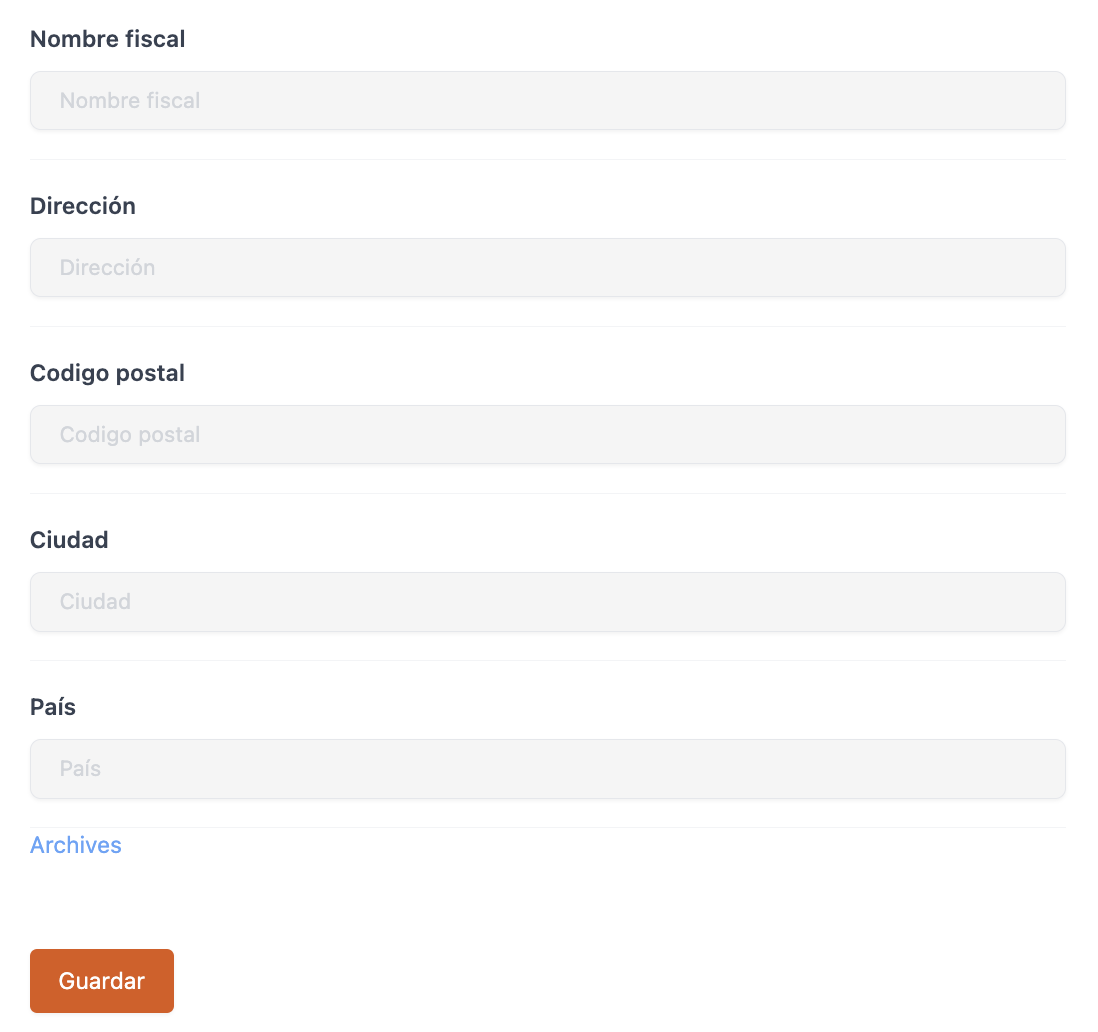

FRANCE

- Alcohol Menu Rate: Create a rate for alcohol and select it. More information about rates here.

- SIRET: Enter your SIRET.

- VAT: Enter the VAT code.

- NAF: Enter the NAF code.

- Tax Name: Enter your tax name.

- Address: Enter your address.

- Postal Code: Enter your postal code.

- City: Enter your city.

- Country: Enter your country.

Here you will find more information about French taxation.

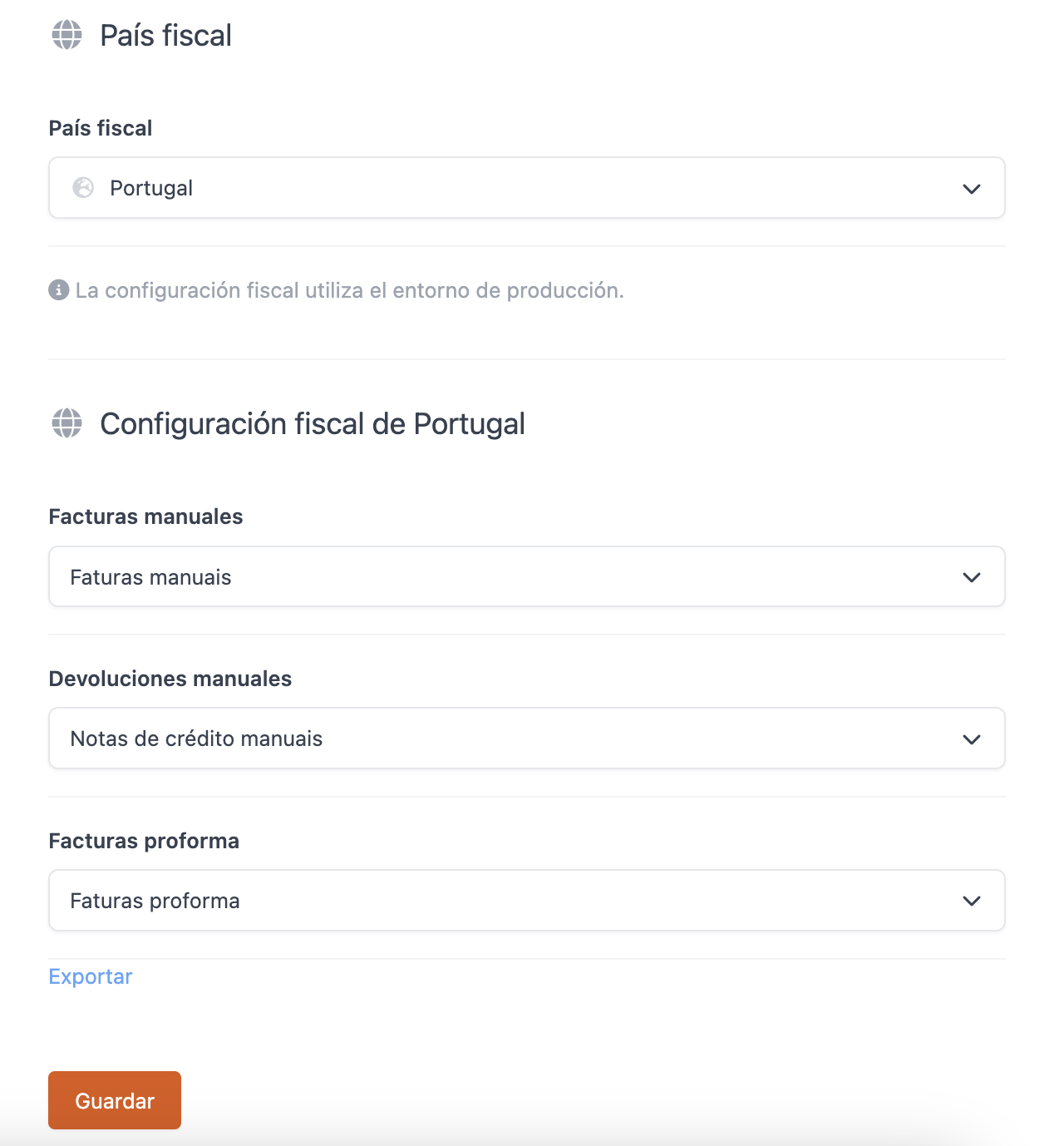

PORTUGAL

- Manual invoices: Select the appropriate invoice series.

- Manual returns: Select the appropriate invoice series.

- Pro forma invoices: Select the appropriate invoice series.

Here you will find more information about Portuguese tax regulations.

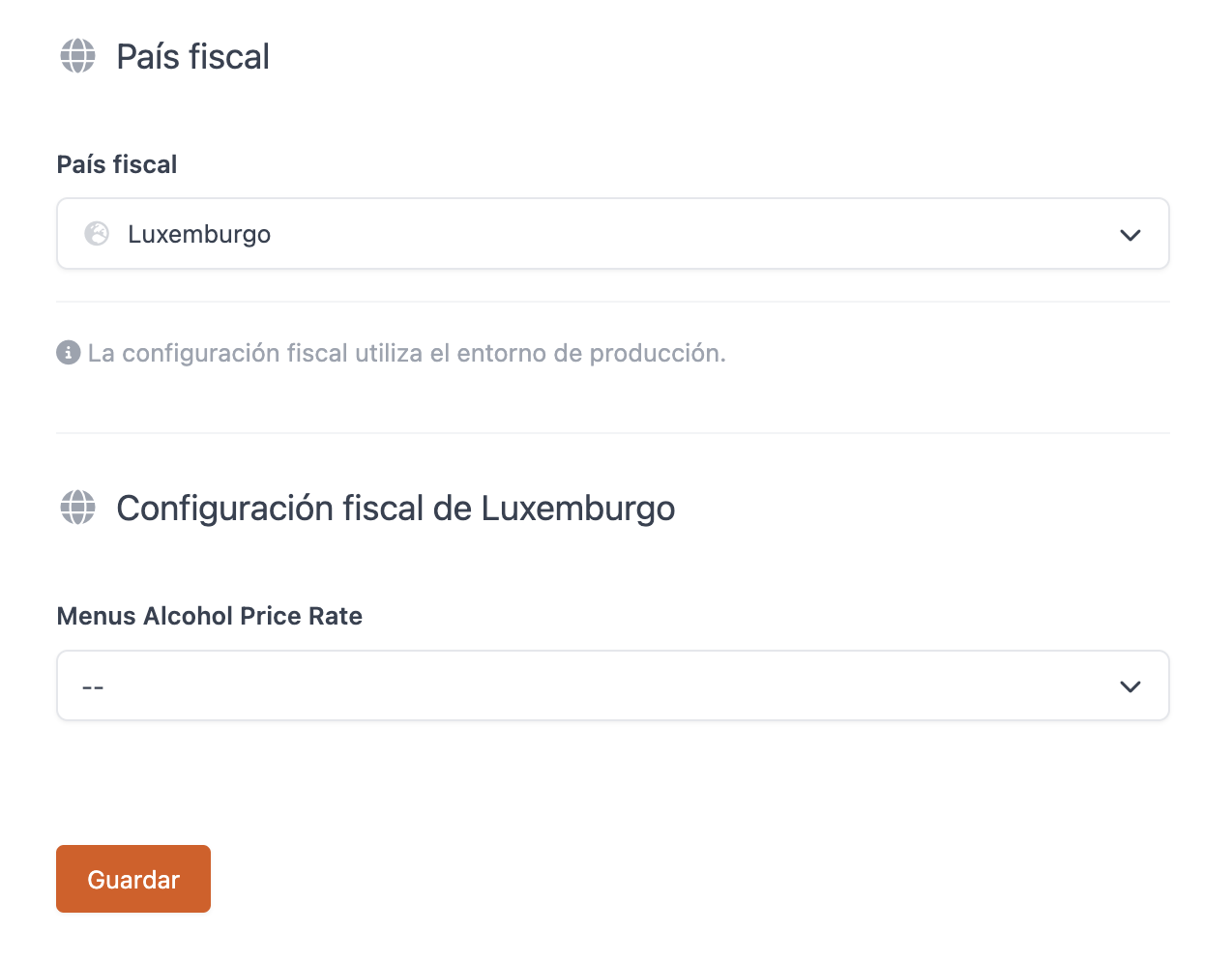

LUXEMBOURG

- Alcohol menu rate: Create and select an alcohol menu rate. More information on rates can be found here.

GERMANY

- TSS ID: Obtain the TSS ID by creating a TSS in the fiskaly dashboard.

- Admin PUK: Obtain the PUK when creating a TSS in the fiskaly dashboard.

- Client ID: This is assigned automatically after initializing the TSS.