Once the customer account has been created, it is important to make sure that the tax configuration is properly set up. To perform this configuration we must follow the steps below:

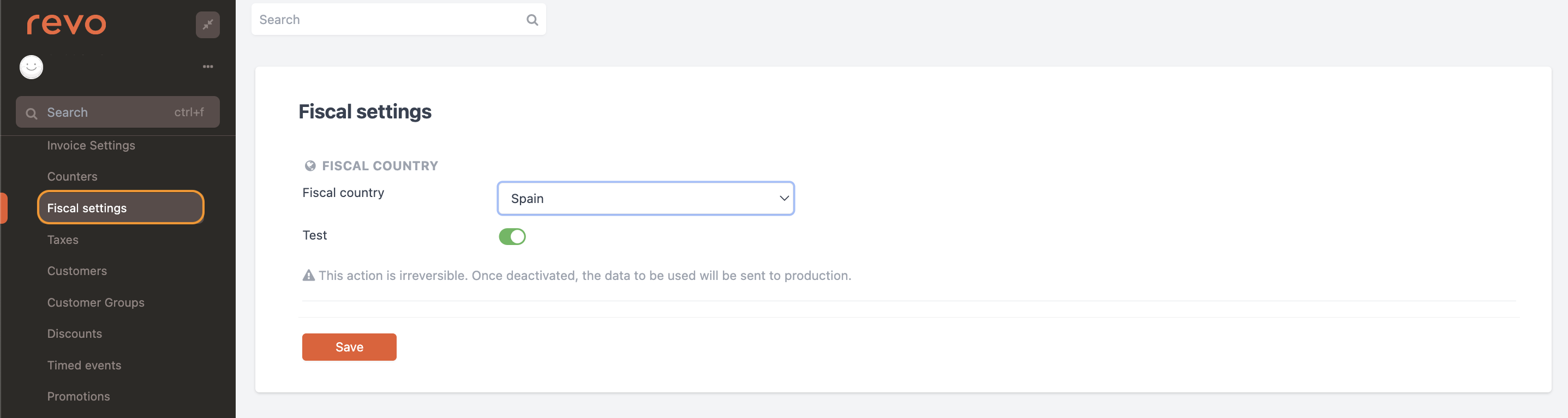

1. Access Revo XEF back-office.

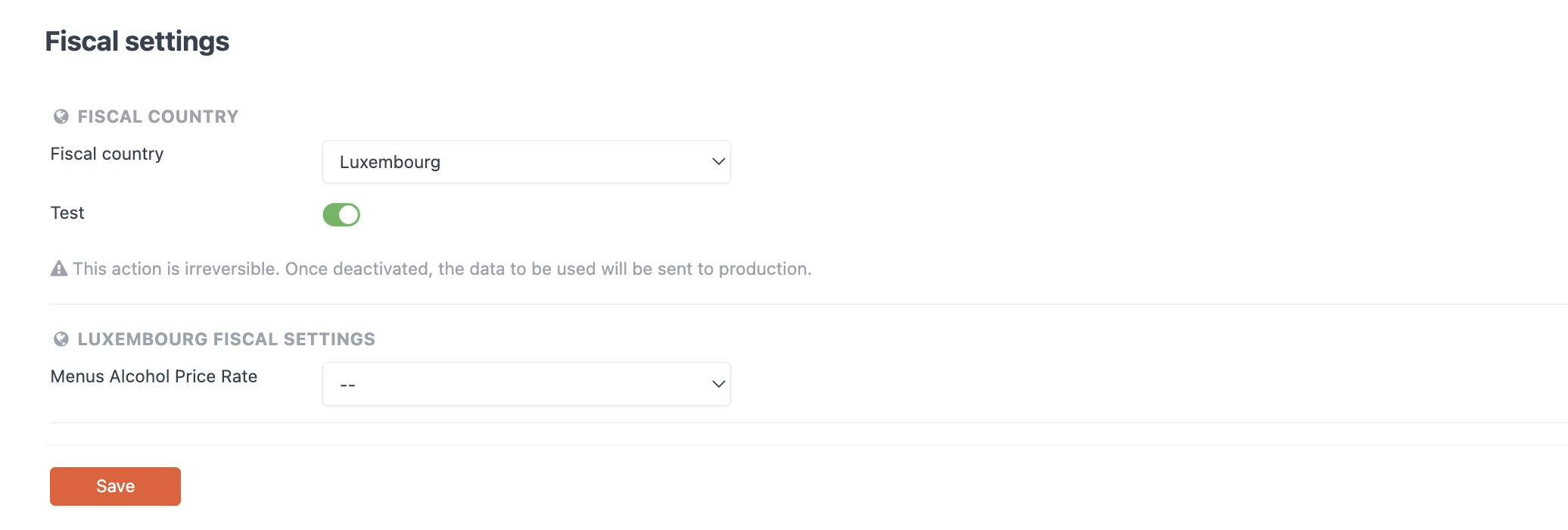

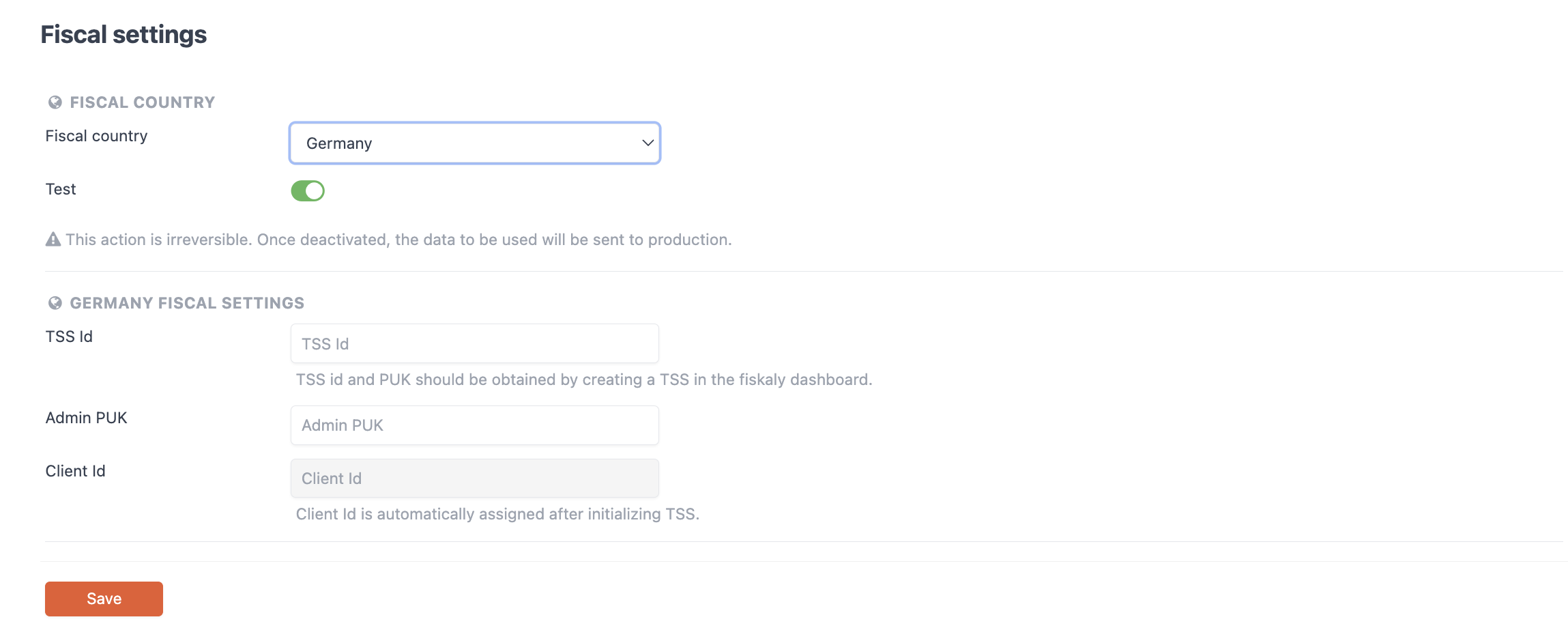

2. Go to Configuration / FISCAL SETTINGS.

-

Fiscal country: Select your country from the drop-down menu.

-

Test: disable once we are ready to send our data to production.

IMPORTANT: This action is irreversible. Once deactivated, the data to be used will be sent to production.

-

Private Key: Add the private key. Once uploaded, a checkmark will appear.

-

Public Key: Add the public key. Once uploaded, a checkmark will appear.

Once the test mode is deactivated, the keys cannot be modified anymore.

3. Finally, click Save to confirm the changes.

HOW E-INVOICE WORKS

Once the private and public keys are added, we can download the e-invoice for individual invoices and grouped invoices. This XML file can be uploaded to the electronic platform.

FISCAL COUNTRIES WITH EXTRA CONFIGURATION

In the case of the Basque Country (Spain), France, Portugal, Luxembourg and Germany we will have to add more information when configuring the taxation.

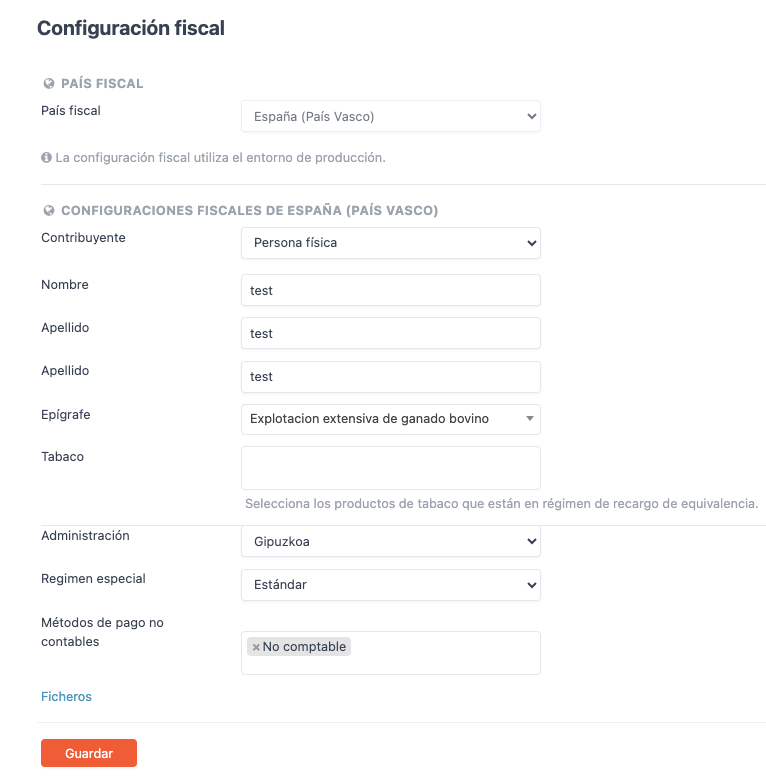

Basque Country (Spain)

-

Fiscal Country: Select Spain (Basque Country).

-

Taxpayer: Select either Natural Person or Legal Entity, as appropriate.

Note: If you select Legal Person not all the options mentioned above will appear.

-

First name: Owner's first name.

-

Surname: Owner's surname.

-

Epigraph: Select the appropriate epigraph for our services.

-

Tobacco: If we have any product that is tobacco, enter it if it is within the equivalence regime.

-

Administration: Select your province (Gipuzkoa, Vizcaya or Álava).

-

Special Regime: Select the one that corresponds to you (Standard, Special equivalence surcharge regime or Simplified special VAT regime).

-

Non-accounting payment methods: Select your non-accounting payment methods.

-

Files: We observe the XML files sent to TicketBAI and their status.

IMPORTANT: More information on Basque taxation from this link.

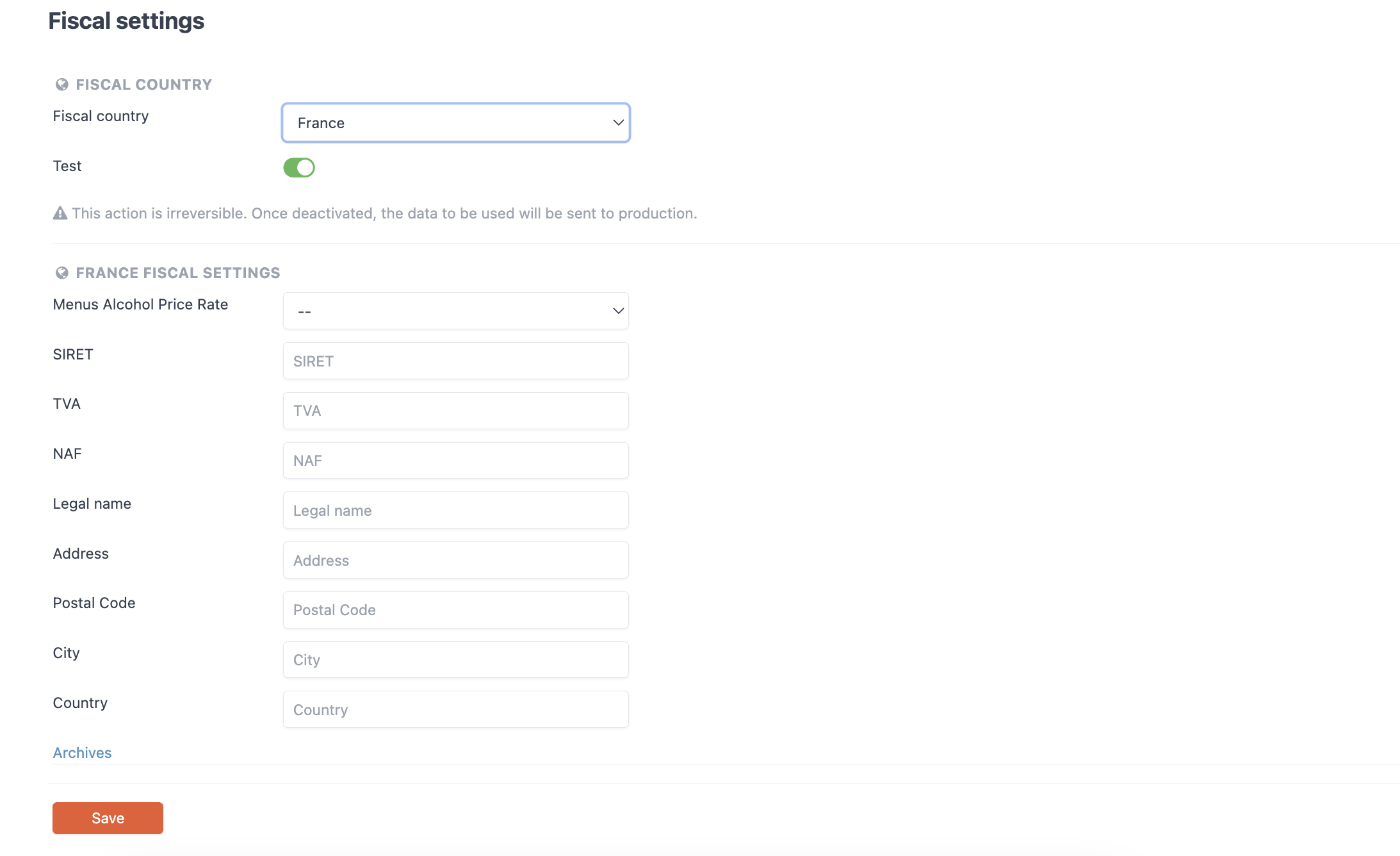

France

- Alcohol menu rate: You will need to create a rate for alcohol and select it from the drop-down menu. More information about rates here.

- SIRET: Enter your SIRET.

- TVA: Enter your TVA code.

- NAF: Enter the NAF code of the company.

- Fiscal name: Enter our fiscal name.

- Address: Enter our address.

- Postal code: Enter our postal code.

- City: Enter our city.

- Country: Please enter your country.

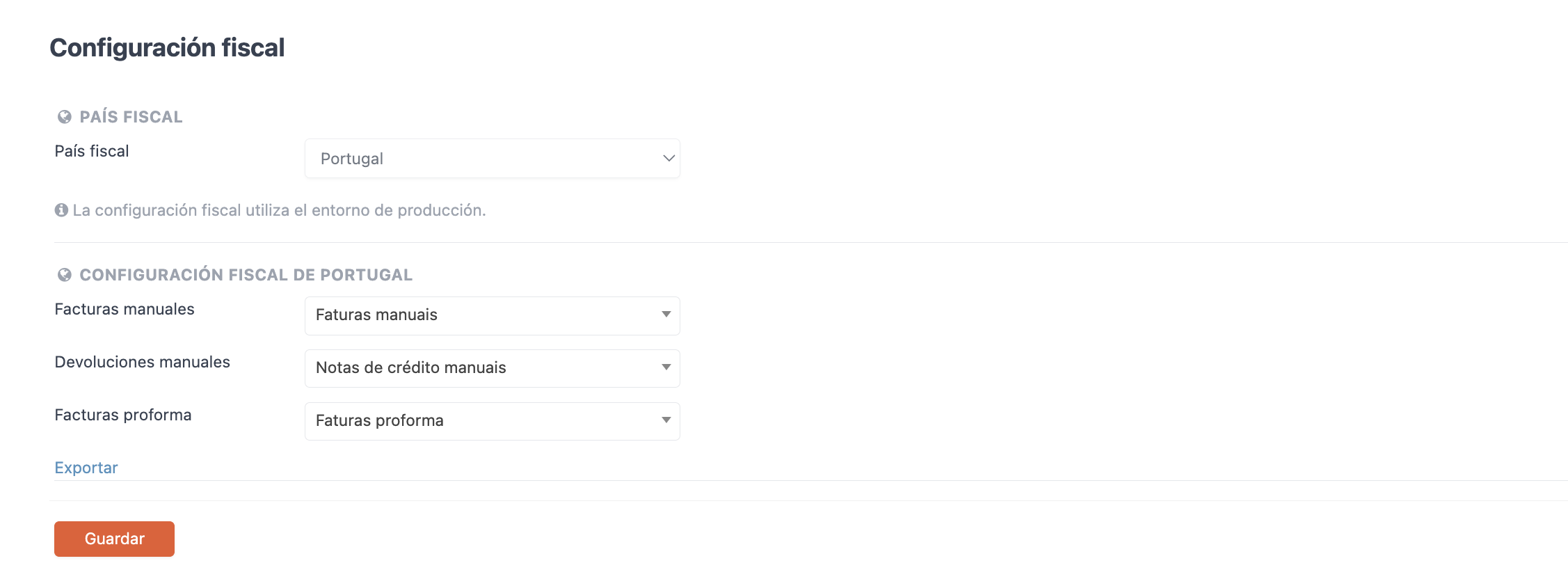

Portugal

- Manual invoices: Select the corresponding invoice series from the drop-down menu.

- Manual refunds: Select the corresponding invoicing series from the drop-down menu.

- Proforma invoices: Select the corresponding invoice series from the drop-down menu.

Note: More information on how to configure our invoicing series can be found here.

Luxembourg

- Alcohol menu rate: You will need to create a rate for alcohol and select it from the drop-down menu. More information about rates here.

Germany

- TSS Id: The TSS ID is obtained when creating a TSS in the fiskaly panel.

- Admin PUK: The PUK is obtained when creating a TSS in the fiskaly panel.

- Client Id: The Client ID is automatically assigned after initialising the TSS.