- STATUS: ENABLED

1. CREATE THE ACCOUNT BY CONTACTING THE ORDERS TEAM 2. CONFIGURE THE "TAX SETTINGS" SECTION IN THE ACCOUNT 3. SET PREFIXES ON THE COUNTERS TO AVOID COINCIDENCES 4. DISABLE THE "TEST" MODE WHEN THE FIRST SHIFT OFFICIALLY START 5. SIGN THE DOCUMENT PROVIDED BY REVO

1. CREATE THE ACCOUNT BY CONTACTING THE ORDERS TEAM

Before registering a client on TBAI, it is necessary to create an account for them. To do this, you must contact our orders team, who will be responsible for creating the account and providing you with the login details. You can contact us by email or phone to start the account creation process.

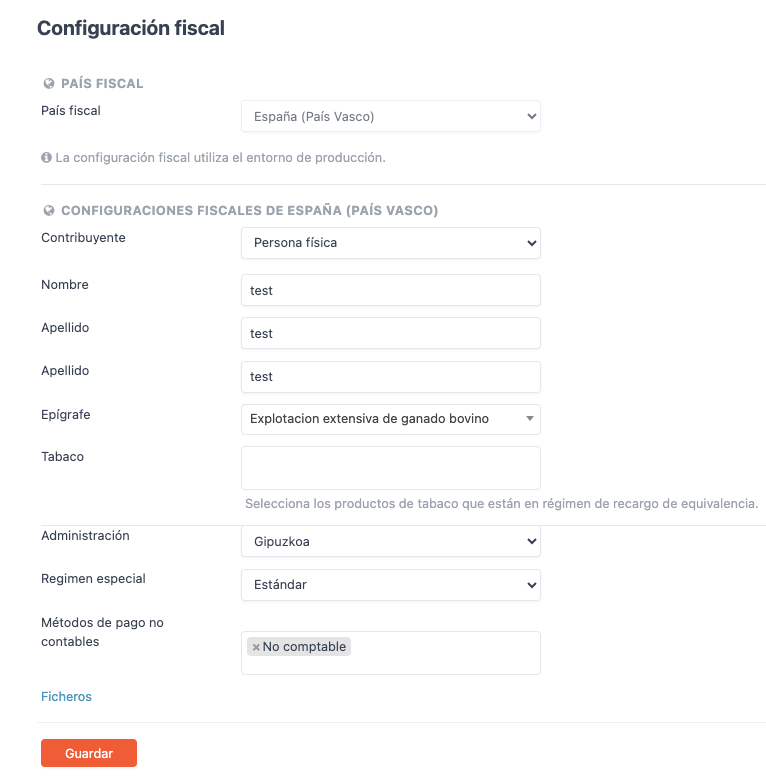

2. CONFIGURE THE "TAX SETTINGS" SECTION IN THE ACCOUNT

When configuring the "Tax Configuration" section in the TicketBAI account for your client, it is essential to take into account the particularities of each province of the Basque Country, since TicketBAI implies differences in tax procedures for the provinces of Gipuzkoa, Vizcaya and Álava .

Once the client account is created, it is important to ensure that the tax settings are properly set up. To perform this configuration, access the Fiscal Configuration. Here you must enter the client's correct tax information, such as their name or company name, address, tax identification number, among others.

-

Tax Country: Select "Spain (Basque Country)"

-

Taxpayer: Select between Natural Person or Legal Person, as appropriate.

-

Name: Owner's name.

-

Last name: Last name of the owner.

-

Epigraph: Select the appropriate epigraph for your services.

-

Tobacco: If you have a product that is tobacco, enter it if it is within the equivalence regime.

-

Administration: Select your province (Gipuzkoa, Vizcaya or Álava).

-

Special Regime: Select the one that applies to you (Standard, Special Equivalence Surcharge Regime or Special Simplified VAT Regime).

-

Non-accounting payment methods: Select your non-accounting payment methods.

-

Files: Observe the XML files sent to TicketBAI and their status.

Note: If you select "Legal Person" not all the commented options will appear.

IMPORTANT: If you want to do tests before officially starting to operate, you can enable the "test" mode in the fiscal configuration. However, keep in mind that once this mode is disabled, the next invoice issued will be automatically sent to the provincial treasury, and this change cannot be reversed.

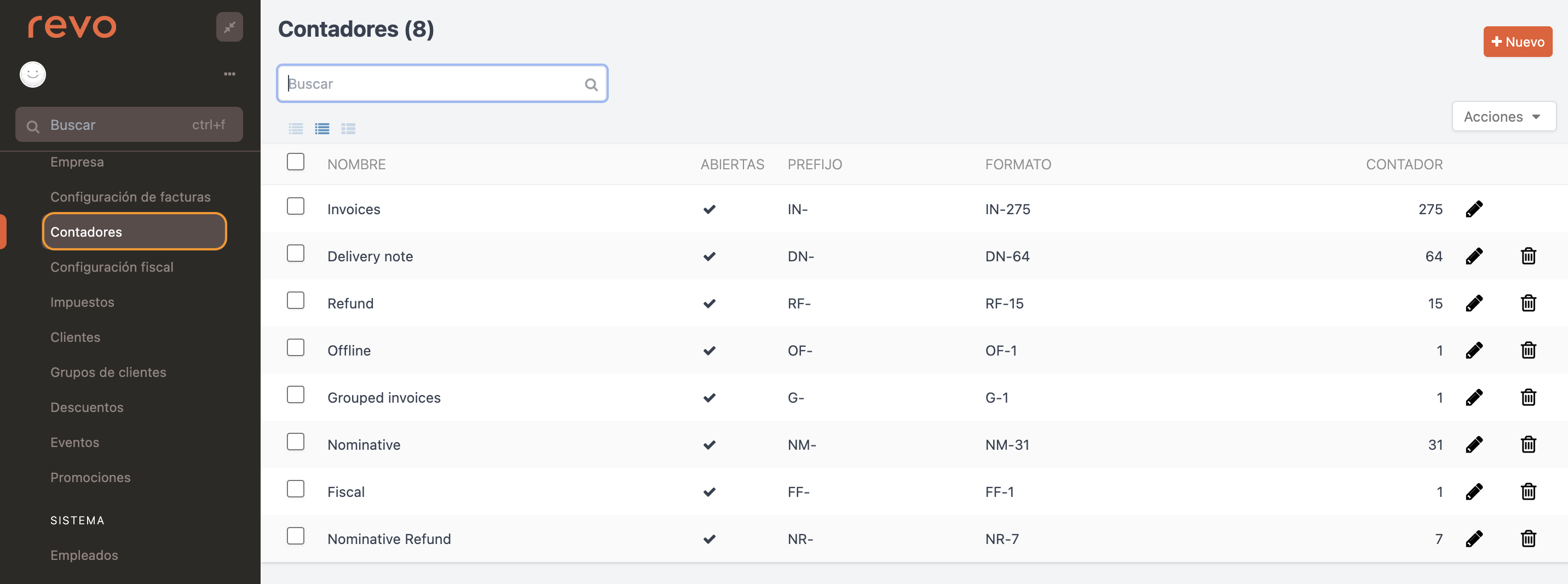

3. SET PREFIXES ON THE COUNTERS TO AVOID COINCIDENCES

In the event that the client has a Master account with several subaccounts under the same tax identification code, it is crucial to configure the prefixes in the meters to avoid coincidences in the billing series sent to the regional treasury. This measure is especially relevant to maintain an adequate record of the operations of each subaccount and avoid confusion in billing.

To configure the prefixes on the counters, go to the Counters. Here you can assign unique prefixes to each subaccount, which will ensure efficient billing management.

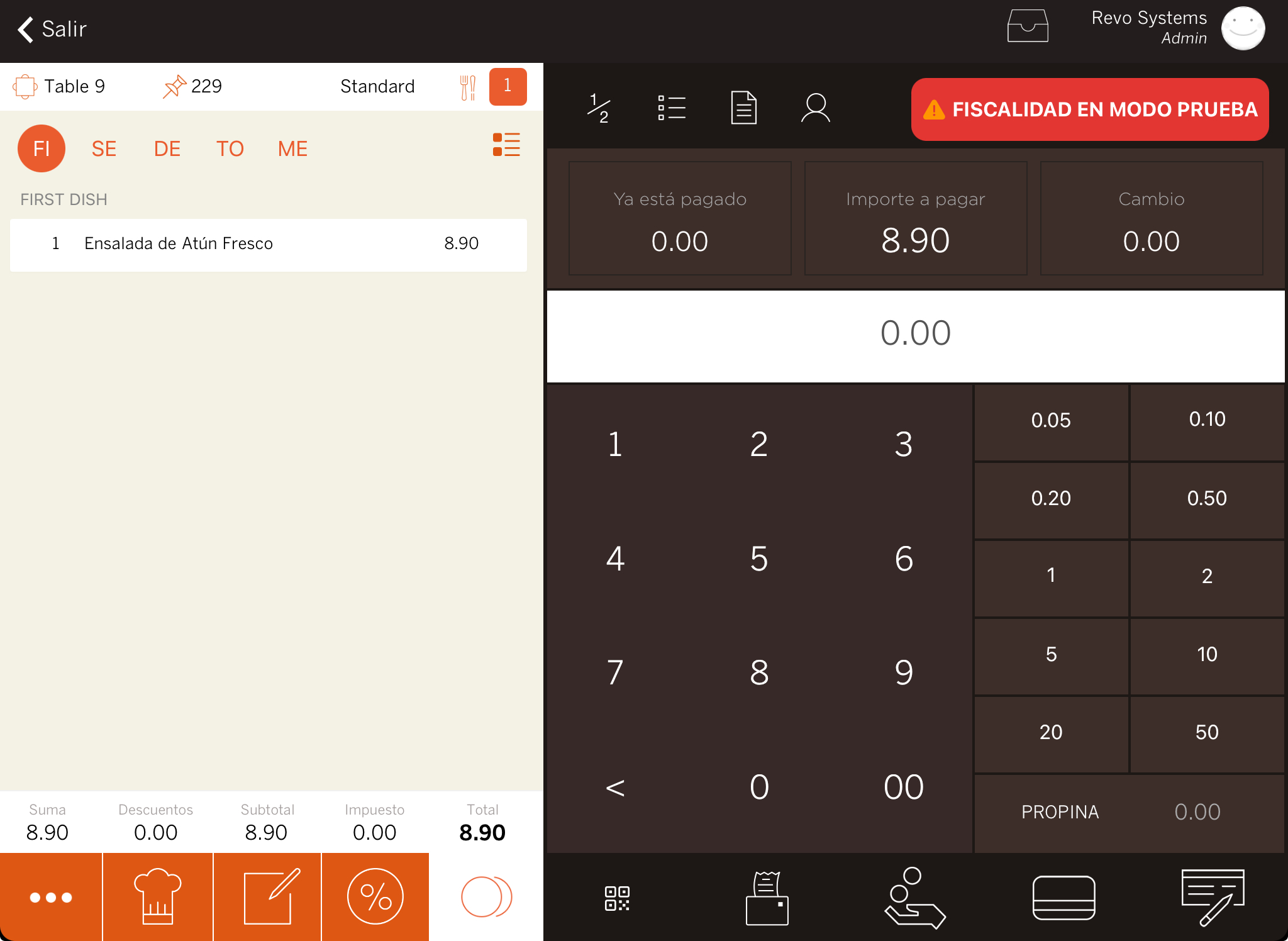

4. DISABLE THE "TEST" MODE WHEN THE FIRST SHIFT OFFICIALLY START

Once all configurations are complete and the client is ready to officially start their first shift, be sure to disable test mode in the tax settings. This will allow the invoices generated to be correctly sent to the provincial treasury and officially registered.

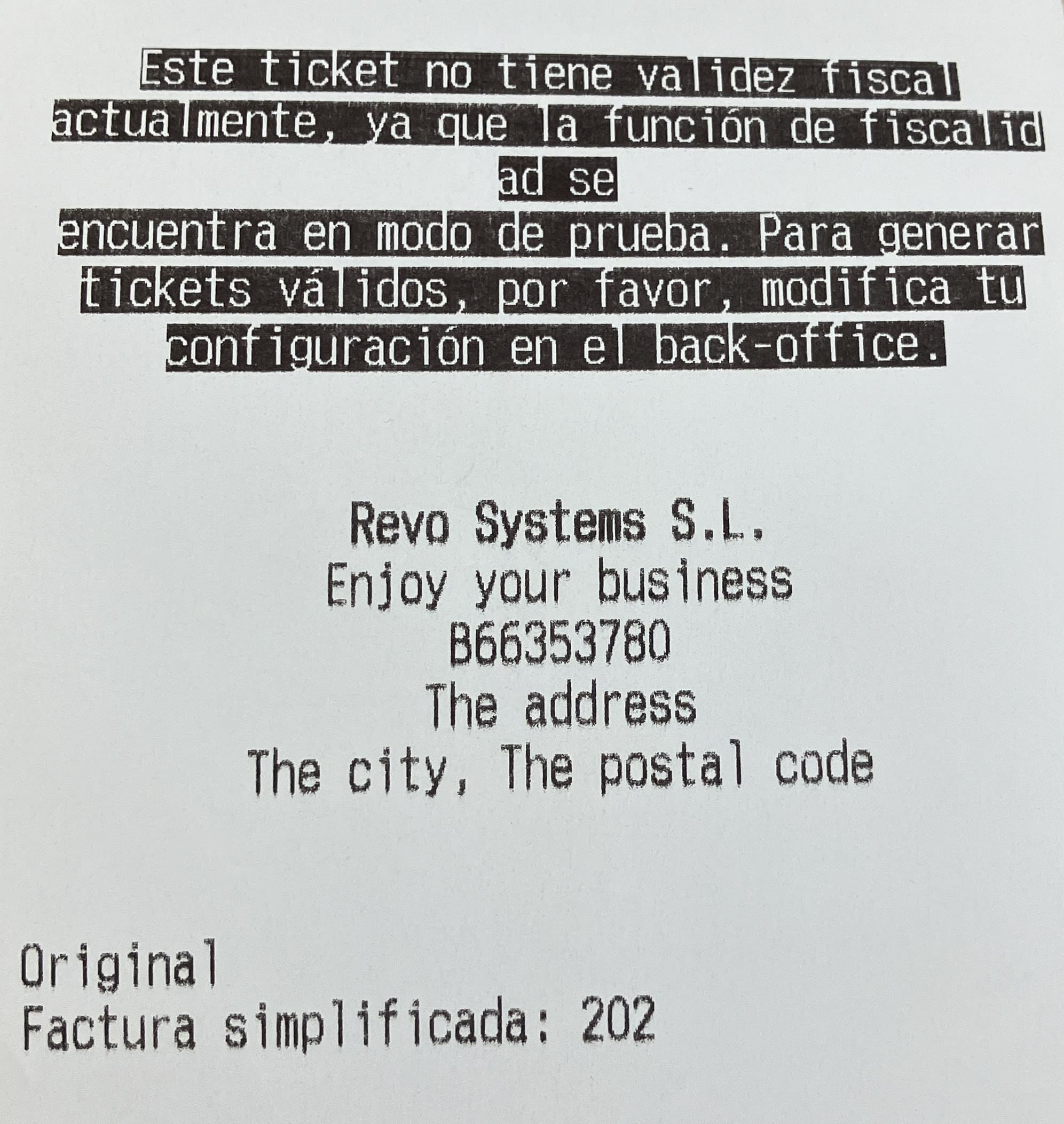

While the test mode is active, an alert will appear on both the payment screen and the receipt indicating it.

5. SIGN THE DOCUMENT PROVIDED BY REVO

To complete the client's registration process in TBAI, our REVO team will send a document that the client must sign.